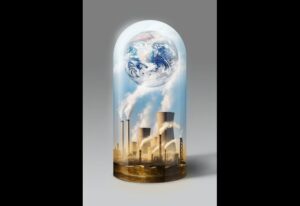

Amsterdam-grounded impact adventure fund Rubio Impact Ventures has blazoned the launch of its third and largest fund to date, Rubio Fund III, raising over €70 million (roughly $80 million) in commitments. The new fund aims to invest in around 30 companies that are developing scalable results to address climate change and social inequality, buttressing Rubio’s charge of combining fiscal returns with measurable impact.

Innovated in 2015, Rubio Impact Ventures has established itself as a frontrunner in Europe’s growing impact investing ecosystem. Over the past decade, the establishment has backed more than 40 high-growth startups concentrated on creating palpable environmental and social value. Its portfolio includes companies similar to Sympower, which supports grid inflexibility and accelerates the renewable energy transition; NoPalm constituents, a biotechnology establishment producing sustainable and indirect druthers

to win oil painting; and OpenUp, a digital platform expanding access to internal health support. These investments reflect Rubio’s commitment to diving into some of the world’s most burning issues while enabling innovative businesses to gauge responsibly.

With the launch of Fund III, Rubio has attracted a different group of investors from both the private and public sectors. The new commitments include benefactions from ING Social Impact Investments and the NN Social Innovation Fund, alongside Dutch entrepreneurs, family services, and institutional mates similar to the European Investment Fund (EIF), Invest-NL, Oost NL, and Brabantse Ontwikkelingsmaatschappij. The Netherlands Enterprise Agency (RVO) has also supported the fund by furnishing an invention loan under the Seed Capital scheme, designed to boost early-stage investment in sustainable and socially salutary gambles.

Speaking on the launch, Machtelt Groothuis, co-founder of Rubio, stressed the growing urgency for business-led climate and social results. “In a period of accelerating climate change and social challenges, the most precious companies of the future are the ones

erecting real results for global problems,” she said. “The launch of our third fund reflects that the impact investing model is honoured, the occasion is clear, and the urgency has in no way been lessened.”

The addition of the new fund brings Rubio’s total means under operation to €220 million, marking a significant step in the establishment’s elaboration. The company intends to continue investing in early- and growth-stage businesses that are concentrated on scalable results within four core themes: climate, circularity, education, and well-being. Rubio’s investment strategy centres on relating to charge-driven entrepreneurs who can achieve measurable impact alongside competitive fiscal performance.

Opining on the advertisement, Rinke Zonneveld, CEO of Invest-NL, emphasised Rubio’s pioneering part in shaping the Dutch impact investing geography. “Rubio is leading the pack in the Dutch impact investing scene. They didn’t just set the standard, they created it,” Zonneveld said. “Especially how they don’t just talk about climate but attack social issues head-on, it’s inspiring others and satisfying institutional investors to enter this space.”

Rubio’s approach to impact investing combines fiscal discipline with measurable social and environmental issues. The establishment laboriously tracks the performance of its portfolio companies across crucial impact pointers, ensuring that its investments contribute meaningfully to sustainable development. This binary focus has helped establish Rubio as a trusted mate for entrepreneurs and investors seeking to make a positive difference while driving profitable growth.

The launch of Fund III comes at a time when impact investing is gaining instigation across Europe. According to recent assiduity data, capital flows into finances targeting climate adaptability, social addition, and sustainable invention have grown steadily over time, driven by heightened mindfulness of global challenges and evolving investor precedences. Rubio’s expansion reflects this broader trend, as more investors seek openings that align with both fiscal pretensions and purpose-driven issues.

By backing startups that combine invention with measurable impact, Rubio aims to accelerate systemic change in sectors critical to a sustainable future. The establishment’s focus on early-stage and growth-stage gambles allows it to nurture transformative ideas and help authors navigate the complications of spanning socially responsible businesses.

With its new fund, Rubio Impact gambles and reinforces its position as one of the Netherlands’ leading impact investment enterprises, shaping a model that bridges purpose and profit. As global requests decreasingly prioritise sustainability and addition, Rubio’s continued growth signals that investing for impact isn’t only a moral imperative but also a feasible path to long-term value creation.